Buying a car is not a fixed-duration task but a series of steps that expand or contract depending on preparation, market conditions, financing status, and dealer efficiency. For a buyer without prior research or pre-approval, the process might stretch across weeks. For a buyer who’s already narrowed down a model and secured financing, it may take as little as a day. Understanding what governs each phase helps eliminate delays and unnecessary repetition.

Research and Decision-Making Phase

The most variable component is the time spent deciding what to buy. This phase can range from several hours to several weeks. It includes identifying use cases (commuting, family hauling, performance, etc.), establishing non-negotiables (fuel economy, size, technology, safety ratings), and compiling a shortlist of models. Many buyers start with online research—review aggregators, manufacturer specs, consumer feedback, and pricing tools.

Once a few models have been identified, buyers often spend additional time scheduling and completing test drives. If a buyer insists on exploring both new and certified pre-owned options, this phase expands further. Buyers also compare reliability ratings, maintenance costs, insurance quotes, and depreciation projections. The decision-making window closes only once there’s clarity on make, model, trim, and acceptable price range.

Financing and Budget Planning

Even if a car has been selected, the absence of financing clarity stalls the purchase. Pre-approval from a bank, credit union, or online lender may take 1 to 3 business days. This includes submitting credit history, proof of income, proof of residence, and sometimes employment verification. Buyers with poor credit may face extended back-and-forth or rejection, requiring them to explore subprime options, co-signers, or larger down payments.

If a buyer intends to finance through the dealership, the time savings are illusory. Dealers can process loans quickly, but the terms may not be competitive. Reviewing APRs, total interest paid, and contract clauses should take hours, not minutes. Buyers often get quoted multiple offers, each requiring comparison. Down payment strategy, loan term length, and monthly budget constraints all converge here.

Budgeting also includes evaluating the total cost of ownership—insurance, fuel, maintenance, and registration. Without accounting for these, buyers may inadvertently overextend.

Dealership Visits and Test Drives

Scheduling dealership visits rarely happens in one afternoon. Even when the model is predetermined, inventory availability and operating hours constrain timing. If multiple dealerships are involved—especially to compare pricing, test drives, or trade-in offers—this phase stretches further.

Test drives generally last 20 to 45 minutes, but waiting for availability, navigating paperwork, and reviewing options can add hours per visit. Some buyers return to the same dealership multiple times before committing. Vehicle inspections, especially for used cars, might involve third-party mechanics or history report analysis, each adding time.

This phase often overlaps with negotiation, as sales staff attempt to move buyers from curiosity to commitment during test drive windows. Savvy buyers remain focused on data rather than pressure.

Negotiation and Paperwork

Negotiating the price of a vehicle—new or used—rarely happens in a single round. Buyers must compare prices against invoice cost (for new cars) or market value (for used ones). Negotiation can be complicated by trade-ins, add-ons, warranties, or financing terms.

Buyers who prepare by checking dealer incentives, rebates, or end-of-month inventory pressure have greater leverage. The presence of a trade-in adds complexity, requiring appraisal, inspection, and title verification. If the vehicle has an outstanding loan, the payoff amount needs to be settled with the lender.

Paperwork—often underestimated—includes signing contracts, reviewing financing disclosures, accepting or declining extended warranties, gap insurance, and additional dealer offerings. Completing these documents at a dealership takes 1 to 3 hours. Errors or omissions may require corrections, adding time.

Delivery and Final Steps

If the buyer takes delivery from dealer stock, the vehicle can often be driven away the same day. However, delays may occur if the car needs a final detailing, accessory installation, or software updates. For custom orders or cars sourced from other locations, delivery timelines extend by several days or even weeks.

Insurance must be active before delivery. Buyers switching providers or adjusting coverage levels might require 1 to 2 business days to finalize the policy. Some states require proof of insurance before issuing temporary plates. Registration and titling may be handled by the dealer or left to the buyer, depending on jurisdiction. Processing times range from a few hours to several days.

If a buyer is transferring plates or applying personalized ones, additional DMV steps are involved. Documentation errors or missing signatures can delay registration.

Factors Influencing the Timeline

Vehicle availability is among the most decisive factors. If the desired configuration is not in stock locally, the dealership may need to locate the vehicle regionally, which can take days. If inventory is constrained due to supply chain issues or high demand, buyers may have to wait weeks for restocking or place a factory order.

Buyer preparedness directly influences speed. A buyer who has researched, secured pre-approval, and reviewed insurance options can cut the process in half. In contrast, an undecided buyer who starts financing and comparison only after setting foot in the dealership will need significantly more time.

Dealership workflow also matters. Efficient dealers schedule test drives, appraise trade-ins, and process paperwork without long gaps. Disorganized dealerships may require repeat visits or lengthy in-store waits.

Buyers opting for online-only transactions or car delivery services can bypass dealership friction. Platforms like Carvana or Vroom streamline the process, sometimes reducing the buying cycle to 48 hours. However, such models limit test-drive access and may come with stricter return policies.

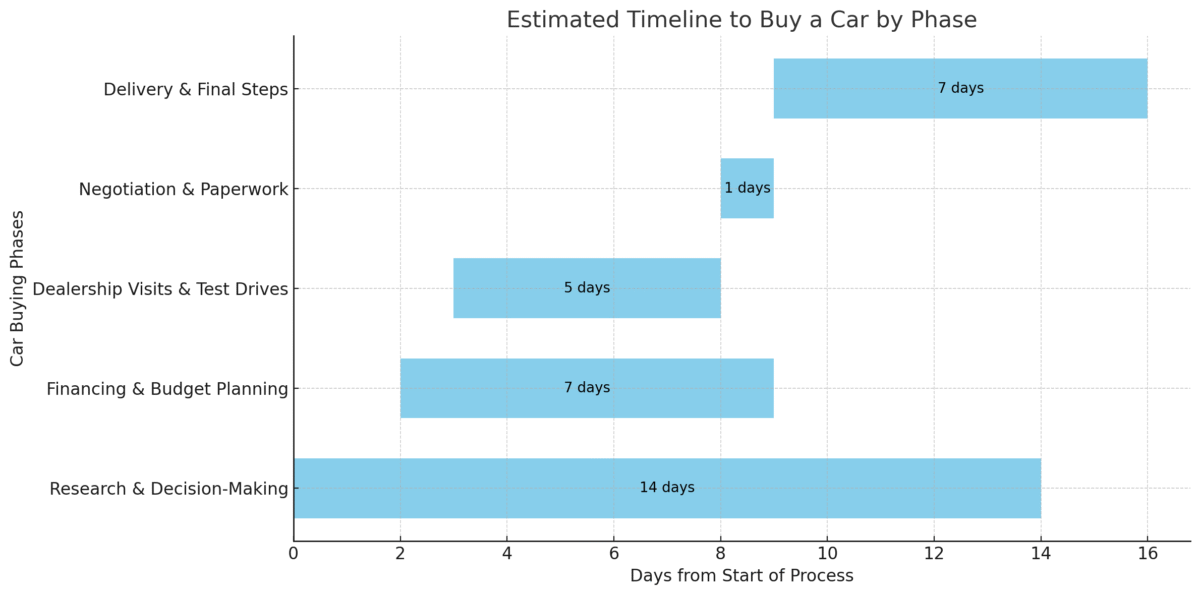

Estimated Duration Summary by Phase (Typical Range)

- Research and decision-making: 2 days to 3 weeks

- Financing and budget planning: 1 to 7 days

- Dealership visits and test drives: 1 to 5 days

- Negotiation and paperwork: 2 to 6 hours

- Delivery and final steps: Same day to 7 days

Driving Ahead: The Top 10 Future Trends in Automotive Digital Marketing for the Next Decade