A car loan doesn’t function as an automatic credit score booster. It introduces a new installment account to your credit profile, but the benefits develop gradually and only under specific conditions. The rate at which your score improves depends on a series of controllable and uncontrollable factors, including your payment behavior, existing credit history, and the structure of your debt obligations.

Initial Impact of a Car Loan on Credit Score

When a lender checks your credit as part of the loan application, the resulting hard inquiry typically causes a small and temporary dip in your score—usually between 5 and 10 points. This impact is more pronounced if your credit history is limited or if you’ve recently applied for other forms of credit. Beyond the inquiry, the loan itself immediately increases your total debt load, which can shift your risk profile in the eyes of scoring algorithms, especially if your credit utilization on revolving accounts is already elevated.

The new account also shortens the average age of your credit, which can temporarily suppress your score, especially in systems like FICO where the age of credit history contributes roughly 15% to your overall rating. Therefore, immediately after taking a car loan, your score may flatten or slightly decline.

Positive Effects of a Car Loan Over Time

If you maintain on-time monthly payments, the loan gradually becomes an asset to your credit profile. Payment history accounts for 35% of a FICO score, and a string of timely installments demonstrates reliability to lenders. Unlike revolving credit, installment loans like car loans reflect a fixed repayment schedule, which reinforces your creditworthiness in a distinct way.

Additionally, a car loan diversifies your credit mix—a factor that represents 10% of your score. Credit scoring models favor borrowers who can manage multiple types of debt, such as credit cards (revolving accounts) and installment loans (auto, student, or personal loans). If your prior credit profile included only one type—such as a single credit card—adding an auto loan demonstrates a broader capacity for managing debt structures.

Over time, your score benefits from the aging of the account. As your car loan matures and your balance declines, credit utilization (for installment loans, the loan balance vs. original amount) improves. This trajectory shows lenders that you’re successfully reducing debt obligations.

Timeline for Credit Score Improvement

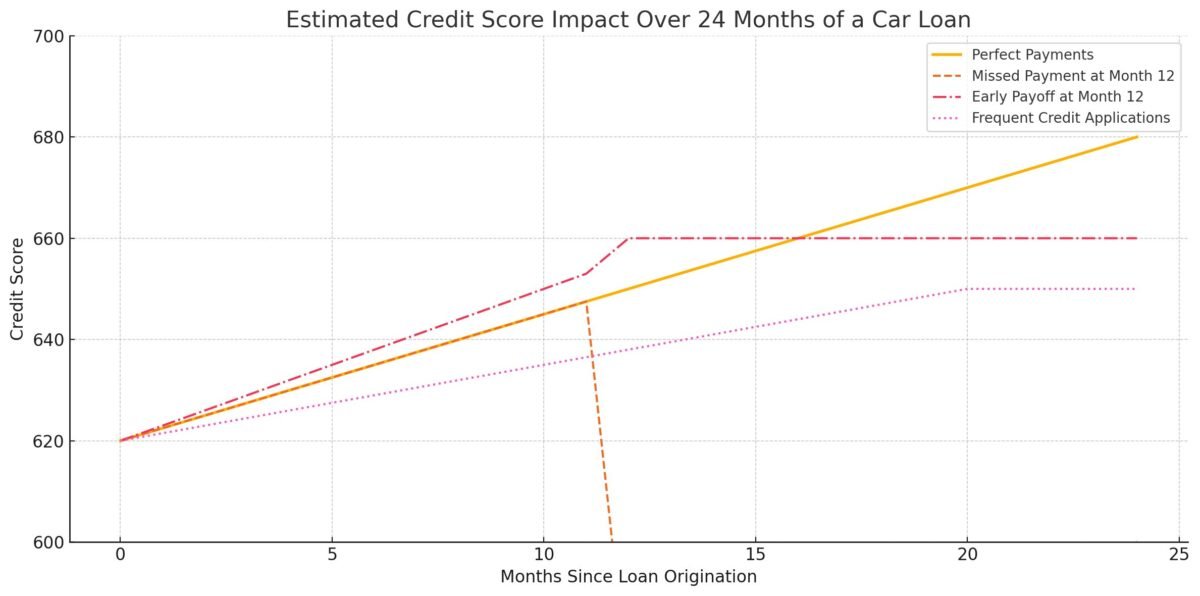

There’s no fixed schedule for how quickly your score will rise after taking a car loan. However, noticeable improvement typically begins between six and twelve months after loan origination, assuming perfect payment history. By the end of the first year, those with limited prior credit may see increases of 30 to 60 points, while individuals with longer histories or multiple existing accounts might experience smaller gains due to diminishing returns.

The initial six months function as a proving ground. Credit scoring models begin to reward the account only once there’s sufficient data to establish a pattern. Missing even a single payment during this period can reset progress and severely damage your score, sometimes by over 100 points.

Factors Influencing the Rate of Credit Score Increase

Your existing credit file determines how quickly the loan exerts a positive influence. If your file is thin—meaning you have few accounts or a short credit history—the new loan fills in gaps and offers greater leverage for upward movement. Conversely, for individuals with well-established profiles, the marginal benefit of adding a car loan is smaller.

Payment consistency remains the most critical variable. Late payments are reported after 30 days of delinquency and stay on your report for seven years. Even one missed installment can counteract multiple years of on-time performance.

Debt-to-income ratio doesn’t directly affect credit scores but influences future lending decisions. If your car loan stretches your budget, the risk of missed payments rises, indirectly harming your score. Lenders can also report accounts as “charged off” or “in default,” both of which produce long-term score suppression and increase the cost of future borrowing.

Strategies to Maximize Credit Score Benefits from a Car Loan

Set up automatic payments to eliminate the risk of forgetfulness. Even if you’re confident in your budgeting, automation removes human error. Use bank alerts or budgeting apps to track due dates if automation isn’t an option.

Avoid refinancing too early. While refinancing can secure better interest rates, it reopens a new account and closes the old one, potentially restarting the cycle of credit age reduction and triggering a new hard inquiry. If you must refinance, wait at least 12 months and ensure your score is in a stronger position.

Don’t apply for additional forms of credit during the first six months of your car loan unless necessary. Multiple new accounts in a short period suggest financial instability and can dilute the score-boosting effects of your loan’s payment history.

Make additional payments only if doing so won’t compromise your liquidity. Paying off the loan early might reduce the interest burden, but it also shortens the lifespan of a positively reporting account. In some cases, allowing the loan to run its course is more beneficial for long-term credit growth.

Potential Pitfalls and How to Avoid Them

Overextending on a car loan can lock you into high monthly payments that outpace your financial capacity. Avoid loans with long terms (72 months or more) unless absolutely necessary. Extended terms reduce monthly payments but increase interest exposure and reduce the pace at which your balance shrinks—delaying credit improvement.

Beware of predatory lenders offering loans with interest rates well above the market average. Subprime auto loans often come with high fees, inflated interest, and aggressive repossession policies. These loans rarely help credit growth unless managed perfectly—and even then, the financial strain often outweighs the benefits.

Avoid co-signing on another person’s car loan unless you’re fully prepared to take on the payment obligation yourself. Any delinquency by the primary borrower affects your credit just as severely, and recovery is significantly harder because you’re not in control of the repayment.

Regularly monitor your credit reports for errors. Inaccurate payment data or misreported loan statuses can stall or reverse credit gains. Dispute any inaccuracies with all three bureaus—Equifax, Experian, and TransUnion—using certified documentation of your loan terms and payment history.